5 Reasons Your Business Needs Flood Coverage

6/24/2021 (Permalink)

5 Reasons Your Business Needs Flood Coverage

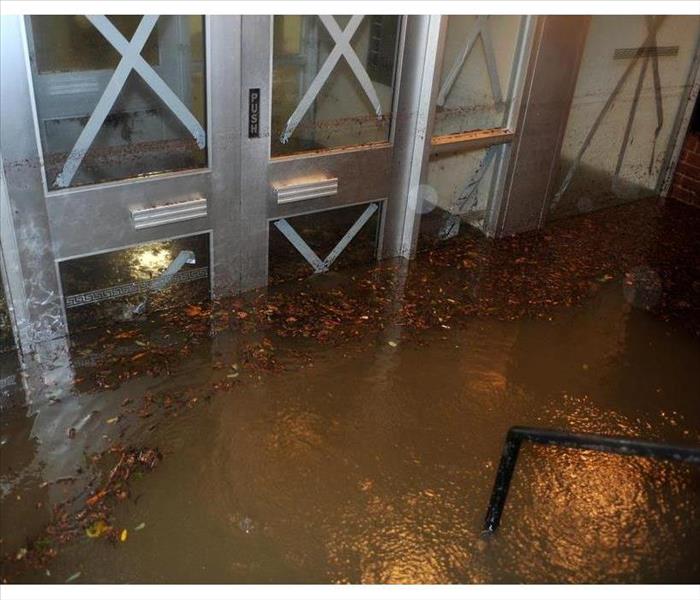

When it comes to flood insurance for your commercial building in Batavia, IL, you may think this is an extra policy you don't need. After all, won't your commercial policy cover any water damages done to your property? However, most commercial storm damage restoration professionals will tell you this is coverage you should get for your business.

1. Flooding might not be covered by property insurance. This of course depends on your policy, but most commercial insurance policies don't help pay for damages done by flooding caused by storms. Your policy could cover some sources of water damage, but you may feel better if you equip yourself with a policy that provides more protection.

2. It can help you replace your belongings. If your business equipment is damaged during a storm's deluge, you may be able to get some help replacing the items. This assistance can help you get your company back up and running quickly after a disaster.

3. It can cover you from various sources of flooding. Most flood insurance policies will cover a wide range of standing water sources, including ice dams, overflowing rivers, blocked sewage systems, or snow melt. Talk with your insurance agent to find out which ones apply for your coverage.

4. You may be at high risk for flooding. Some areas have a higher flood risk than others. If your property is in a low-lying area or hurricanes are common in your locale, you may want to strongly consider adding a specialty policy to your coverage.

5. It can help you remove mold caused by standing water. After water permeates your building, you have a risk of accruing secondary damage, such as mold growth. Many policies for floods will help pay for restoration after mold damage is found.

Flood insurance can help protect your property and your business from damages caused by a storm. Without a special policy added to your property insurance, you may have a major gap in your coverage.

24/7 Emergency Service

24/7 Emergency Service